It’s a war. Again and again and this time it happens in Iran. It is often said that bitcoins feed on chaos: the proof would appear in his block Genesis, engraved on eternity – “The Times 03/Jan/2009 – Chancellor on the second rescue for banks”. But what if chaos is no longer financial, but geopolitical?

Since 2022, two main conflicts – Russia – Ukraine and Israel – Hamas – have broken down the world order. Let us observe the BTC market: a retrospective dive in two acts.

Only one certainty: The price of King Kryptos is moving. If this roller coaster is exhausted, I know I have launched a “25 %” stable and regular strategy that focuses on +25 % per year.

This article contains association links that allow you to support the daily work of teams in a local newspaper.

Russian War – Ukraine – 24 February 2022

24 February 2022, evoking the “security” of Moscow and rejection of westernized Ukraine, the Kremlin triggered and invasion Total, which brutally violates the balance of cold in Eastern Europe.

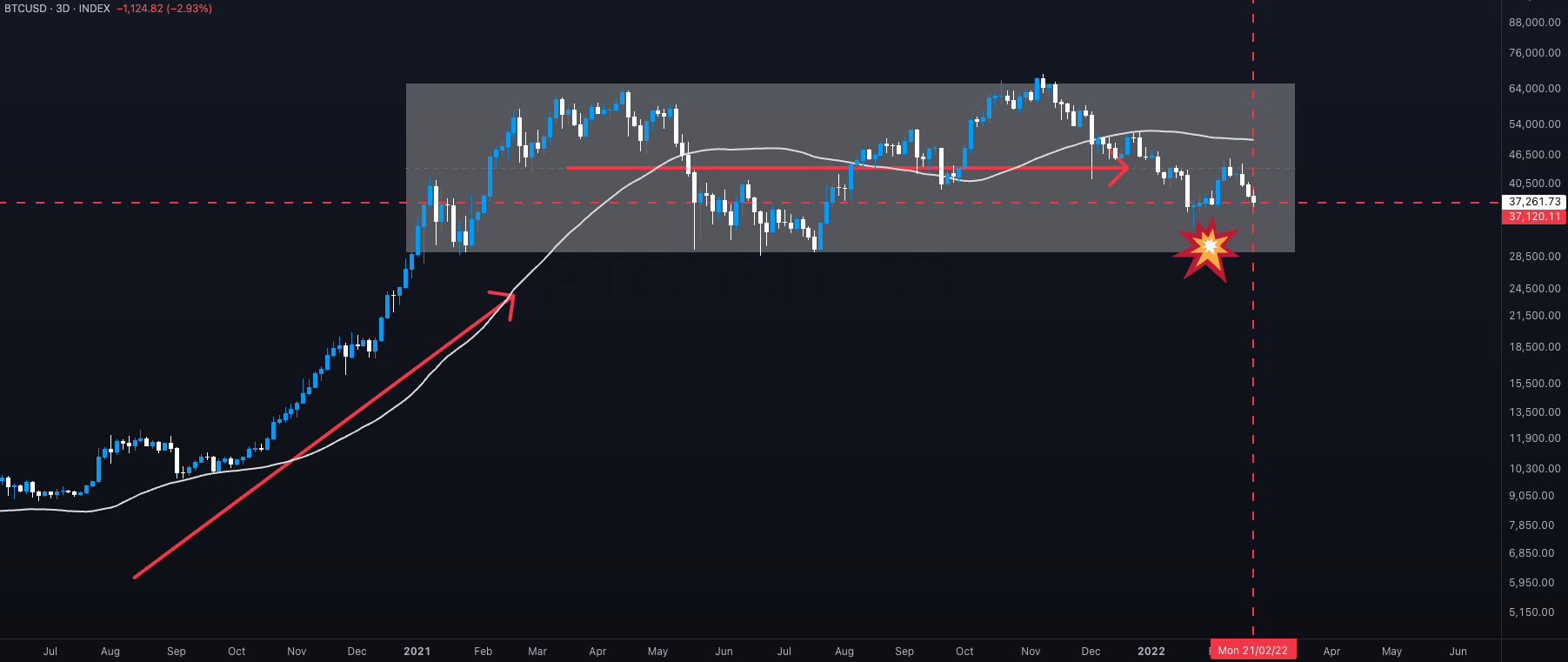

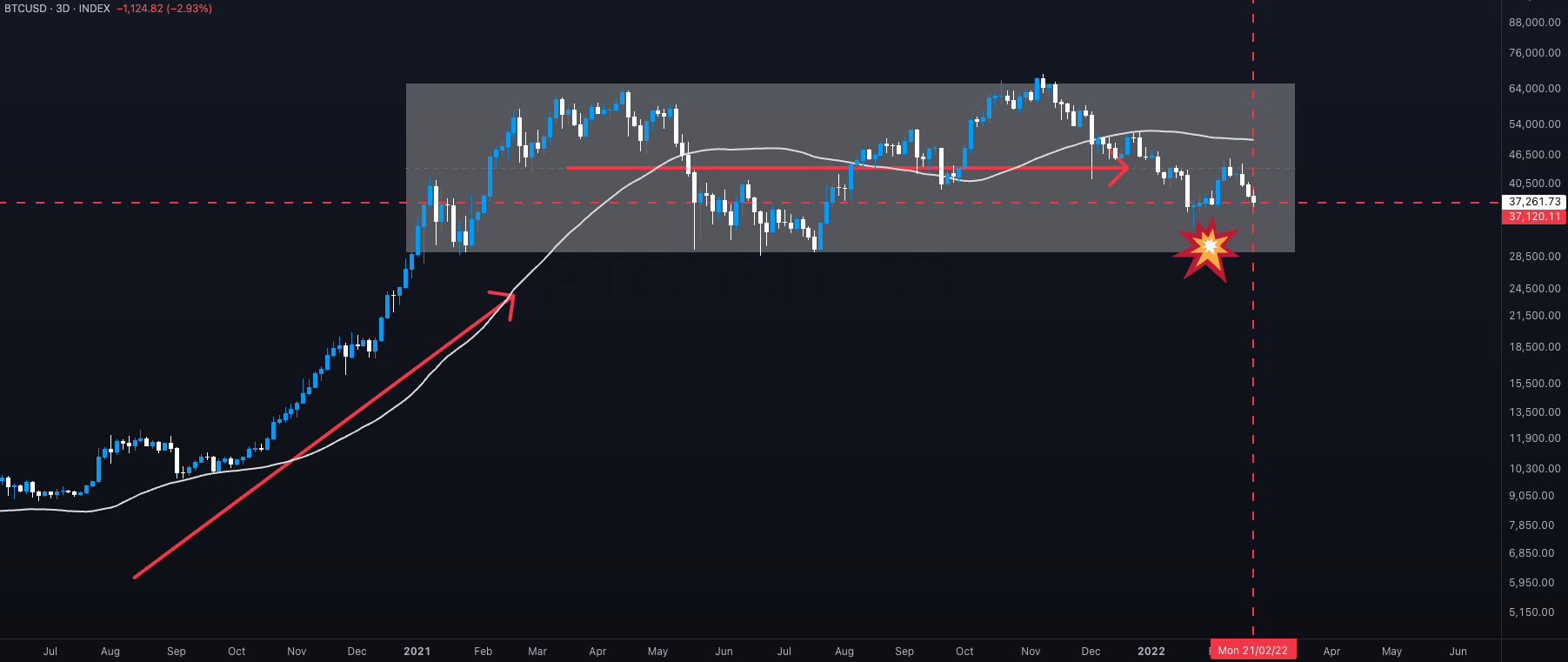

Bitcoin before invasion of Ukraine

We get out as Bull-run Express ($ 10,000 → $ 60,000 in six months) and has been sailing for almost a year in lateral consolidation. No signal honestly down: The factual trend remains awake but the market is hesitantdigestion of the previous dazzling ascent.

Start of War: A dazzling pump and a bitcoin brutal landfill

24 February 2022, offensive day, Bitcoin reacts to the tide : The magnificent upper pulse even verifies and Breakout technical. Short -term euphoria: As the markets are aware of the extent of sanctions and geopolitical shock, the BTC turns around and in a few weeks Plummy begins by more than 50 %.

It is really a war that caused Bear trend ? It’s hard to decide.

Also, read: How to make +25% return per year without taking management?

Israel War – Hamas / Palestine – October 7, 2023

October 7, 2023 led Hamas Flash attack From Gaza, the deadliest against Israel since 1948, it will overthrow the security calculations in the region and break the illusion of permanent status quo. Israeli professional harassment, massive strikes and attic entrances cause a great humanitarian crisis in Gaza, polarizing world diplomacy and reviving fractures in the Middle East.

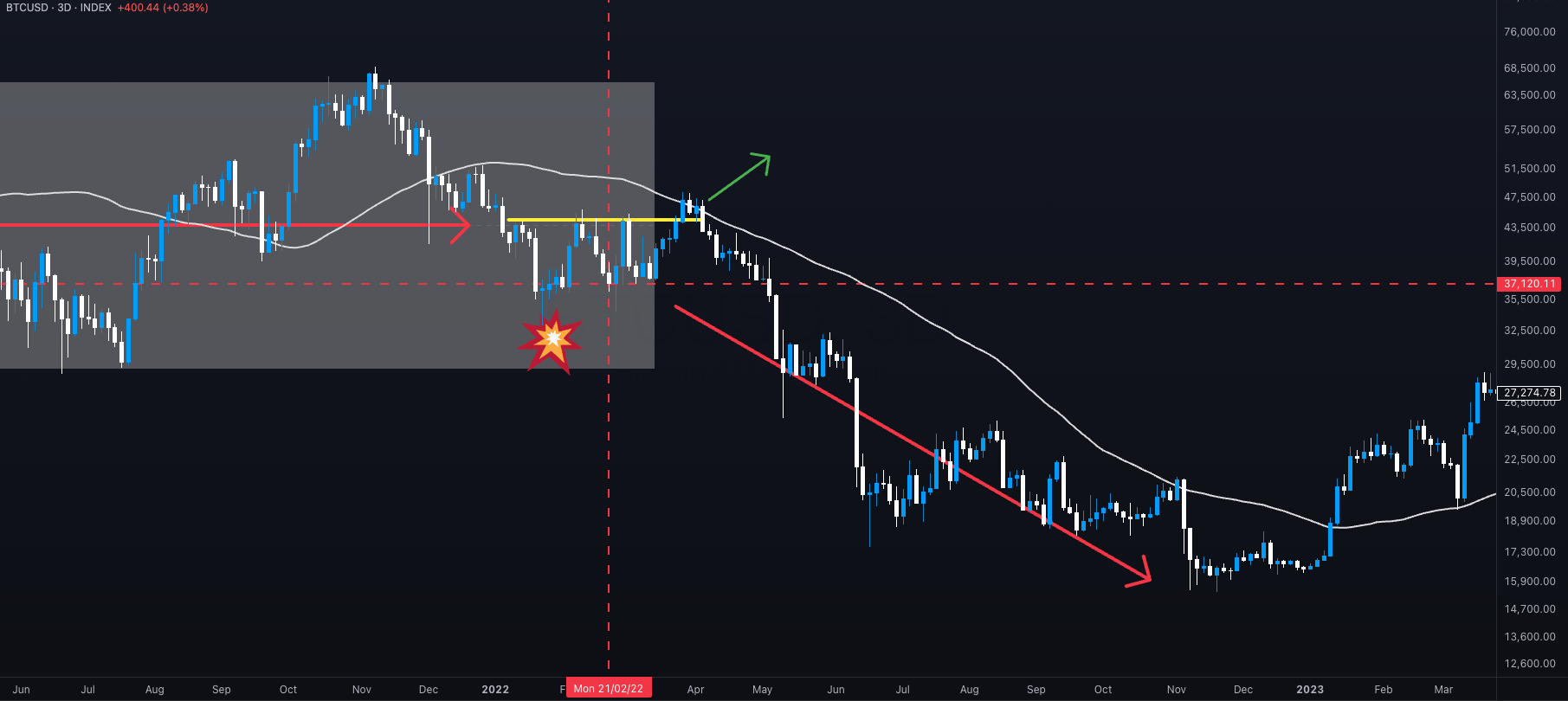

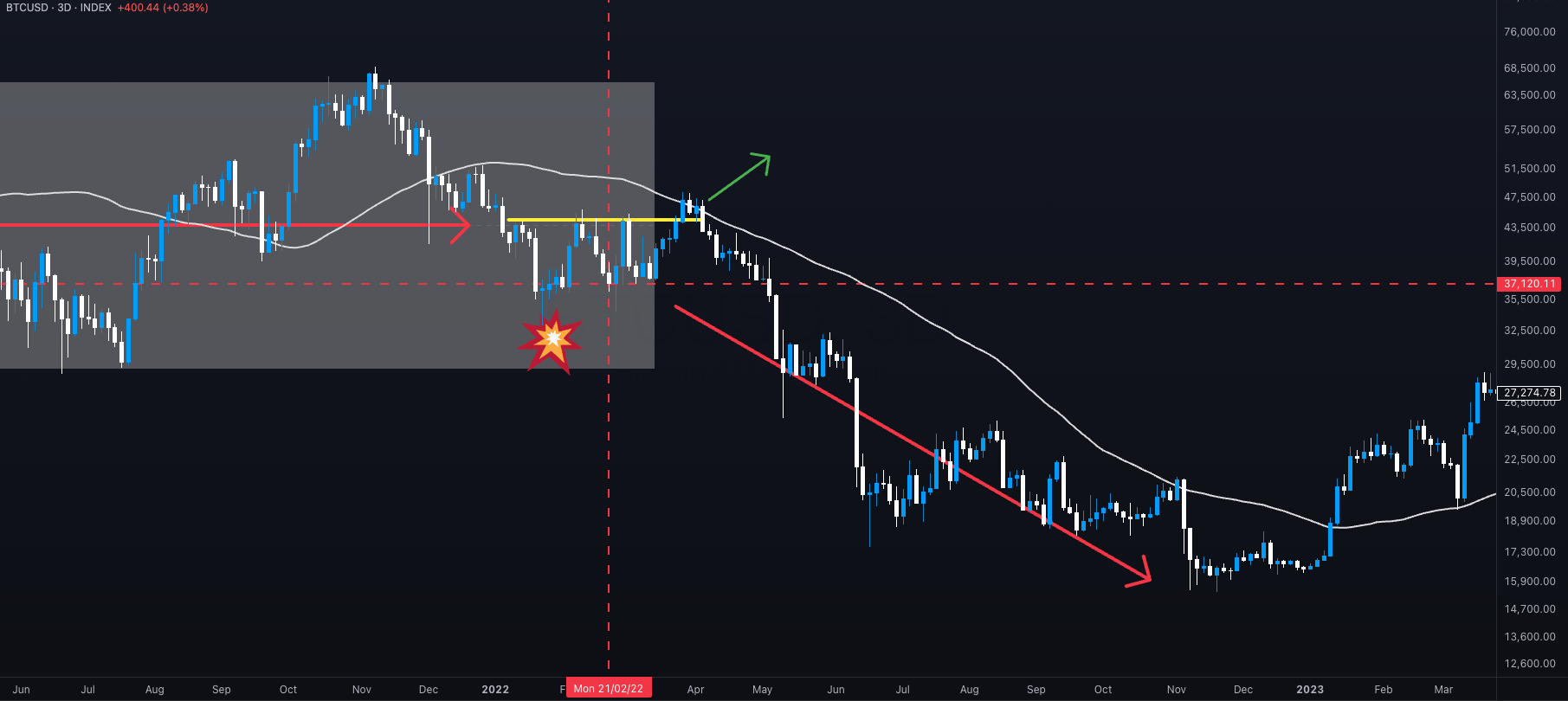

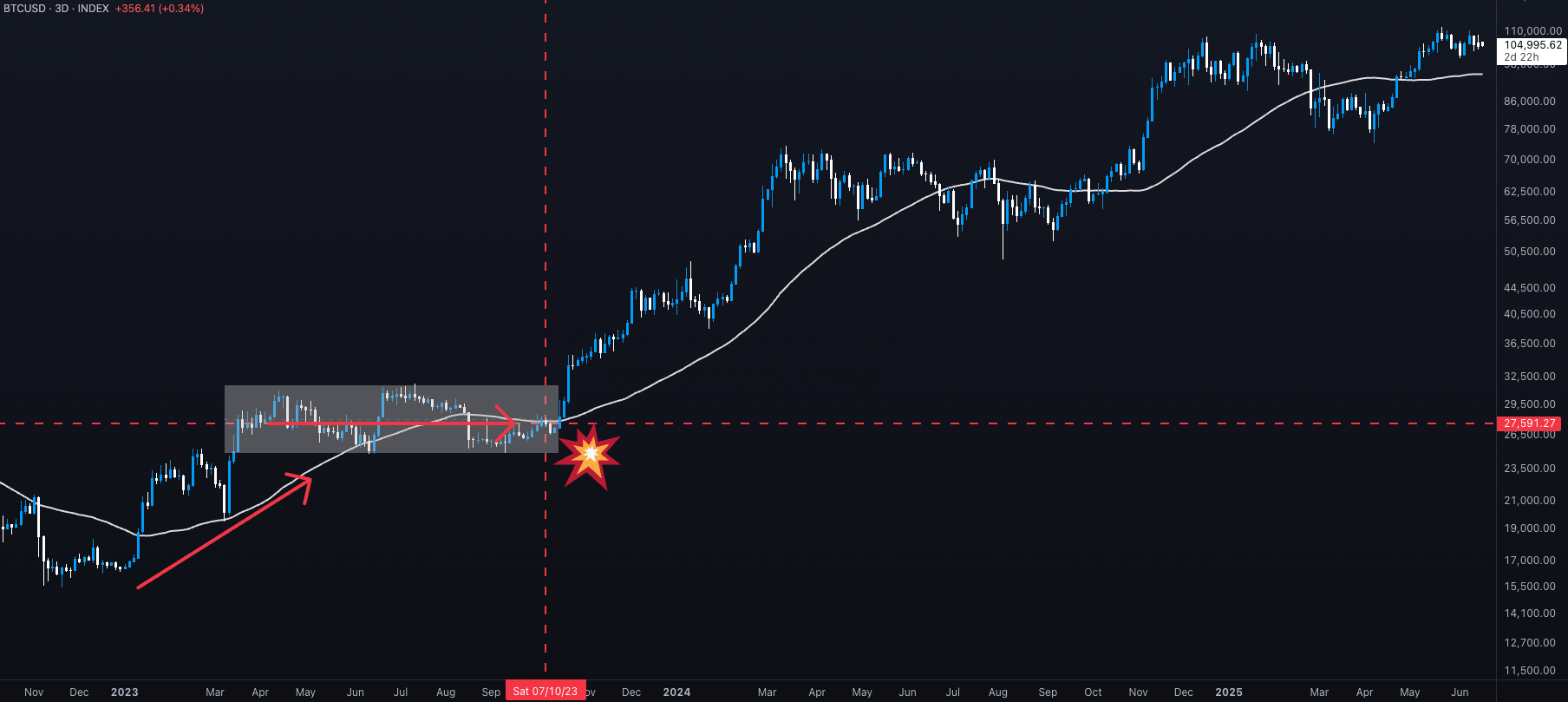

Bitcoin before intensifying the Israeli-Palestinian conflict

From a technical point of view Configuration resembles 2022… But for a shorter term:

- We leave the historic bear market ($ 69,000 → $ 15,000) and we have just landed;

- A clear upward recovery has settled;

- This is followed by a well -designed side consolidation.

The market is at the intersection:

- Breakout Haussier → Restoring Taurus.

- Breaks for breakfast → extended consolidation, or even return below $ 15,000 if the lowest give up.

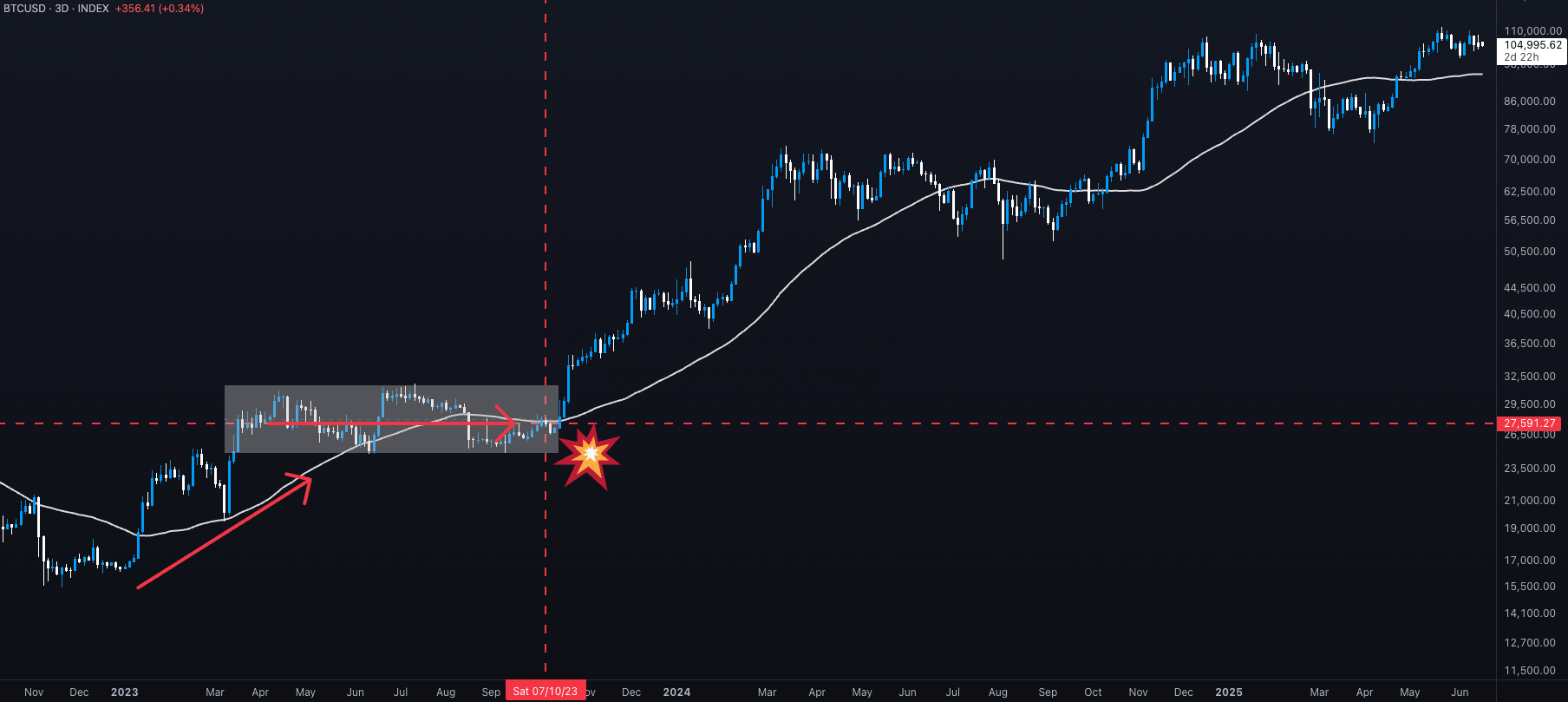

Bitcoins reaction after the reinforcement of the Israeli-Palestinian conflict

The picture is worth a thousand words: after giving up -50 % during the Russian -crainic shock, Bitcoin reacts here. After the attack of 7 October 2023, the BTC ignited, monitors almost flawless ascending trend and virtually double value – +100 % in a few months.

Are you too exposed to the market?

Under the geopolitical storm, Bitcoin becomes a storm under a steroid : Sudden gusts, brutal flash, ruthless sea for wallets. In the ecosystem crypto, however, there are often two extreme positions that are either exposed to 100%or unfortunately Noiner.

Result:

- When the market is lit, Anesthesia Euphoria anesthesia ;;

- When they dive, Panic to crush the reason (and sleep).

To see if your post is in line with your risk tolerance, I have prepared Ultra -fast miniagnostics Reserved for the first 100. Click this link to access this link 👇

>> Subsex or excessively exposed? It’s time to diagnose! 5 questions for checking your exposure during the war <

It’s very fast, it will help you step back and get clarity. A small investment in time to avoid great regret, whether you are irritated … or too exposed.

PS: I send you personalized answers, written with my little hands, so it will take some time. With the start of the accounting crypt, I had no time to prepare any automation. Thank you for your understanding!

(Tagstotranslate) Technical analysis