Fear, uncertainty and doubts about paroxysm. The The market feeling in the bitcoin sector (BTC) is obviously grim Since climbing the conflict between Iran and Israel. Some analysts consider this to be an exaggerated FUD (Fear, uncertainty and doubt). And it is true that if small investors panic, their institutional whales continue to buy cryptos with balance.

- The Bitcoin market has recently been marked by a grim implemented conflict between Iran and Israel, aroused fear and uncertainty among investors.

- Despite the panic of small investors, a large institution continues to accumulate bitcoins that could announce an unexpected ascending recovery.

A market that remains shared between optimism and pessimism, despite the FUD intensity

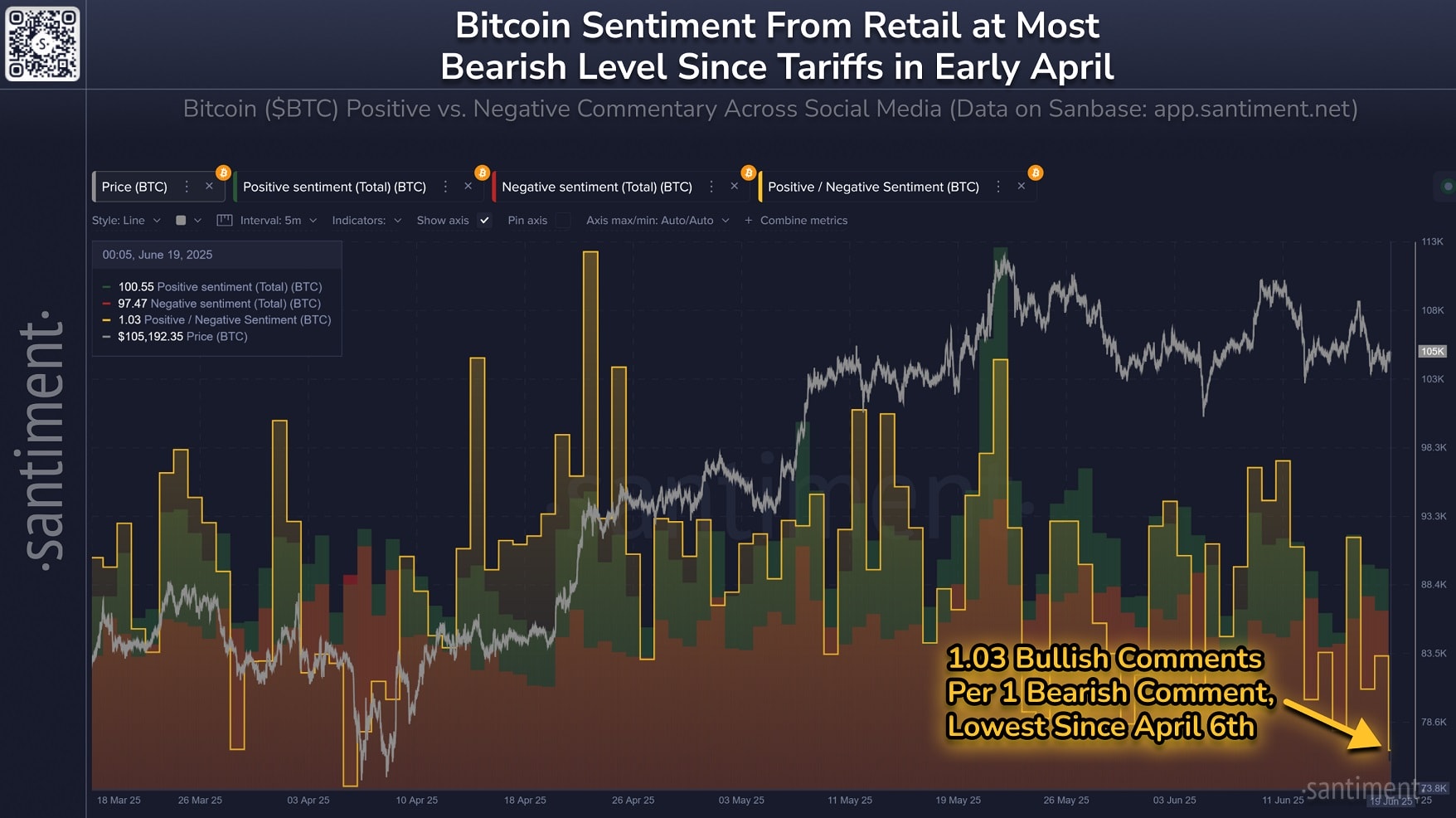

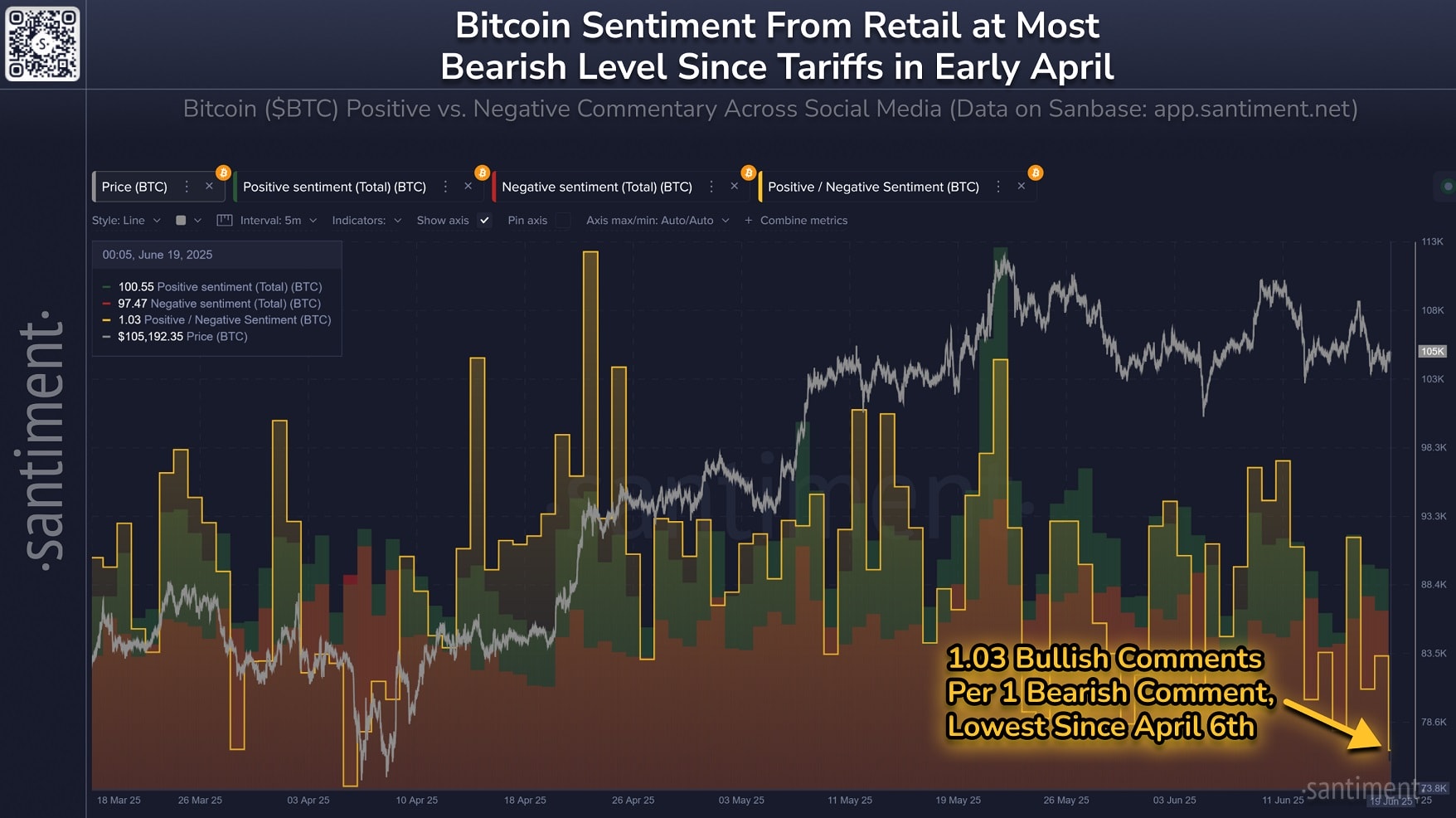

According to data from the analytical platform on-thee Suck (see graphics below), currently there is only 1.03 Comment bull (Haussier) for 1 comment bear (reducing) on social networks.

Such a ratio has not been observed From the top of FUD last April, to the announcement of US customs duties President Donald Trump. A little paradoxically is such a low ratio in general Considered the bull signBecause it suggests that privacy investors are mainly pessimistic, which can point out a Trends of conversion.

“(…) Historically markets develop opposite Expectations of private investors. A perfect example is the optimal time to buy at the beginning of April 2025, when the merchants (individuals) were panicked. (…) ”

Brian Quenti, Santiment Marketing Director

Whales accumulate bitcoins, sold small investors

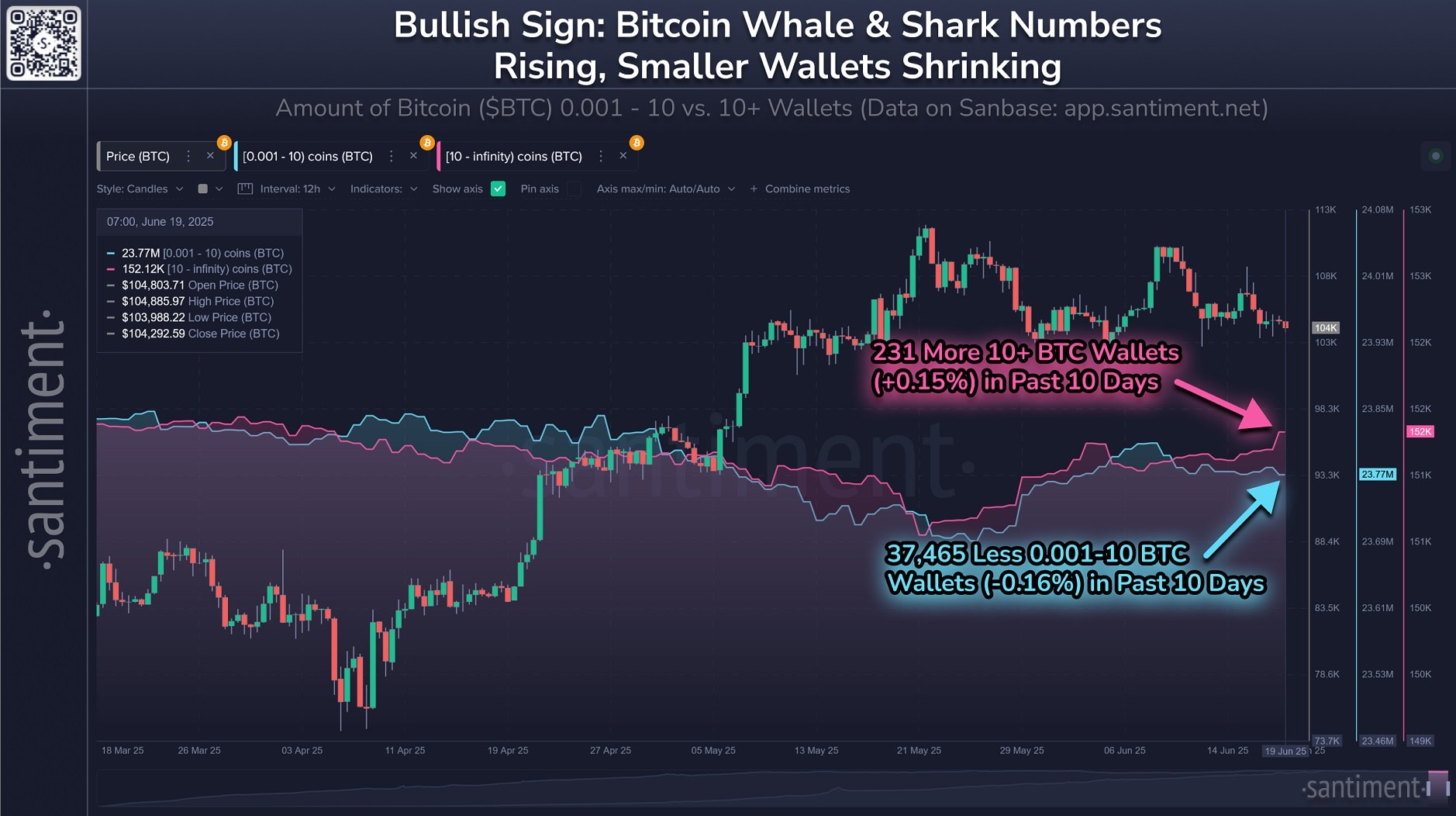

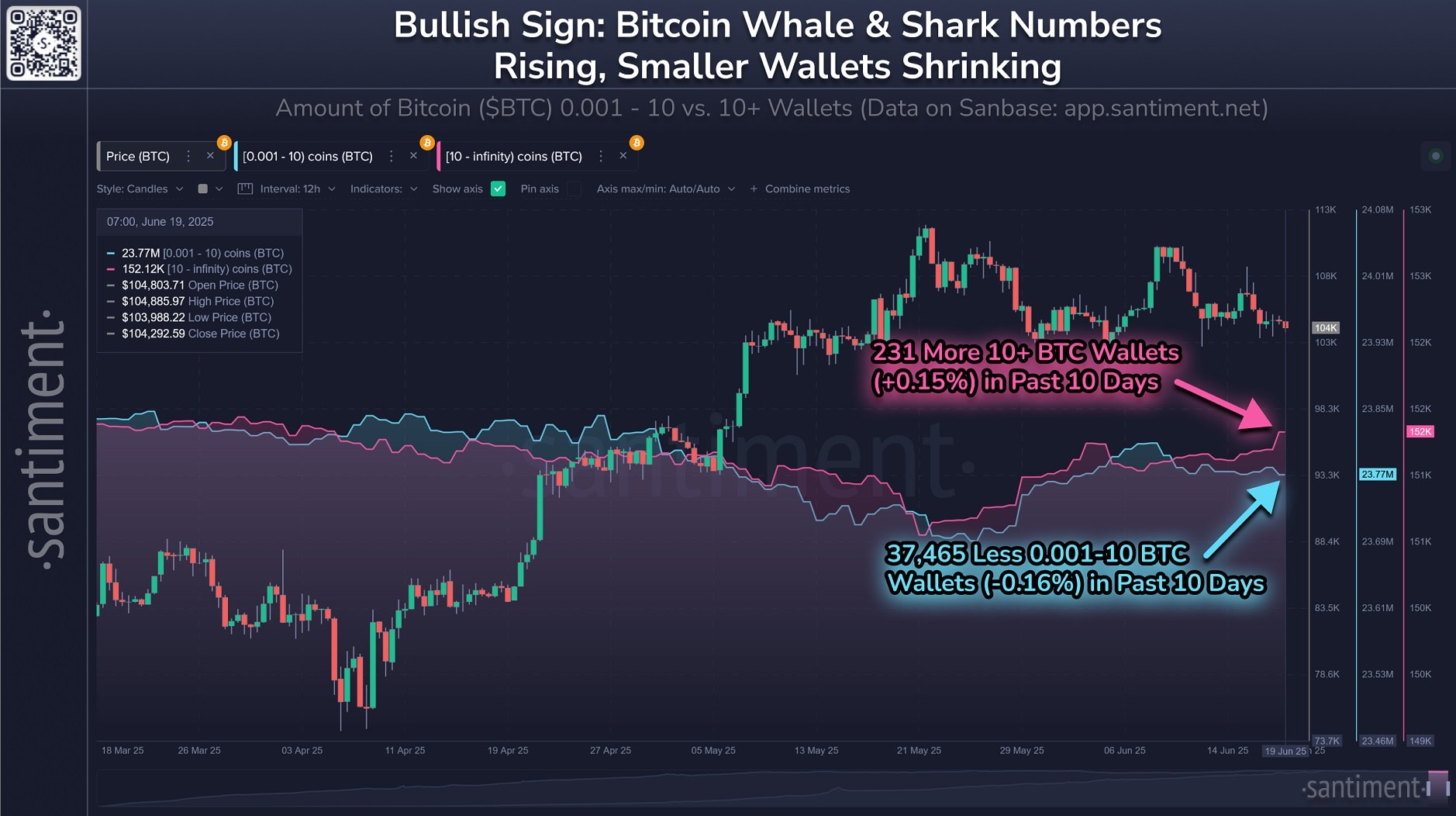

On the same day, in another of his analyzes, Brian Quinlivan, marketing director of Santiment observed very narrated movements in the wallet Bitcoin. Really where small Portfoluments tend to lose bitcoinswhere fat wallets strengthen.

As Brian Quinlivan emphasizes (see chart below) in the last 10 days, 231 New Wallets have exceeded the accumulation of more than 10 BTC (more than $ 1 million during the current course) while more than 37,000 wallets Holding between 0.001 BTC ($ 105) and 10 BTCs have ‘ sold (Or at least reduced) their assets.

This phenomenon where Great investors accumulate bitcoins while small investors sellis often considered a sign Bull. With the exaggeration of FUD, which was previously visible, do we have two foreplay for bull recovery on the crypto market? Watch the whales.

(Tagstranslate) institutional