In the summer of 2020, the crypto ecosystem witnessed the transformation of size through the development of decentralized finances. From now on, it is increasingly interesting for institutions. And that, the Defo protocols understood it. For example, Aave announced its desire to launch RWA platform for institutions. But this is just the emerging face of the glacier. In fact, more and more institutions are exploring the defi directly to the string.

- In the summer of 2020, there was a decentralized finance of historical transformation and is increasingly capturing institutions.

- Since the beginning of 2025, the Krypto Managers have four times their assets on the chain and have reached extraordinary peaks.

- Defi is claimed as basic financial infrastructure, integration of stablecoins and active people for optimized return.

Gigants Crypto Management Giants increases their positions

This week, Analytics Artemis AND Vaults have published a message that reveals the massive growth of wee chain activities.

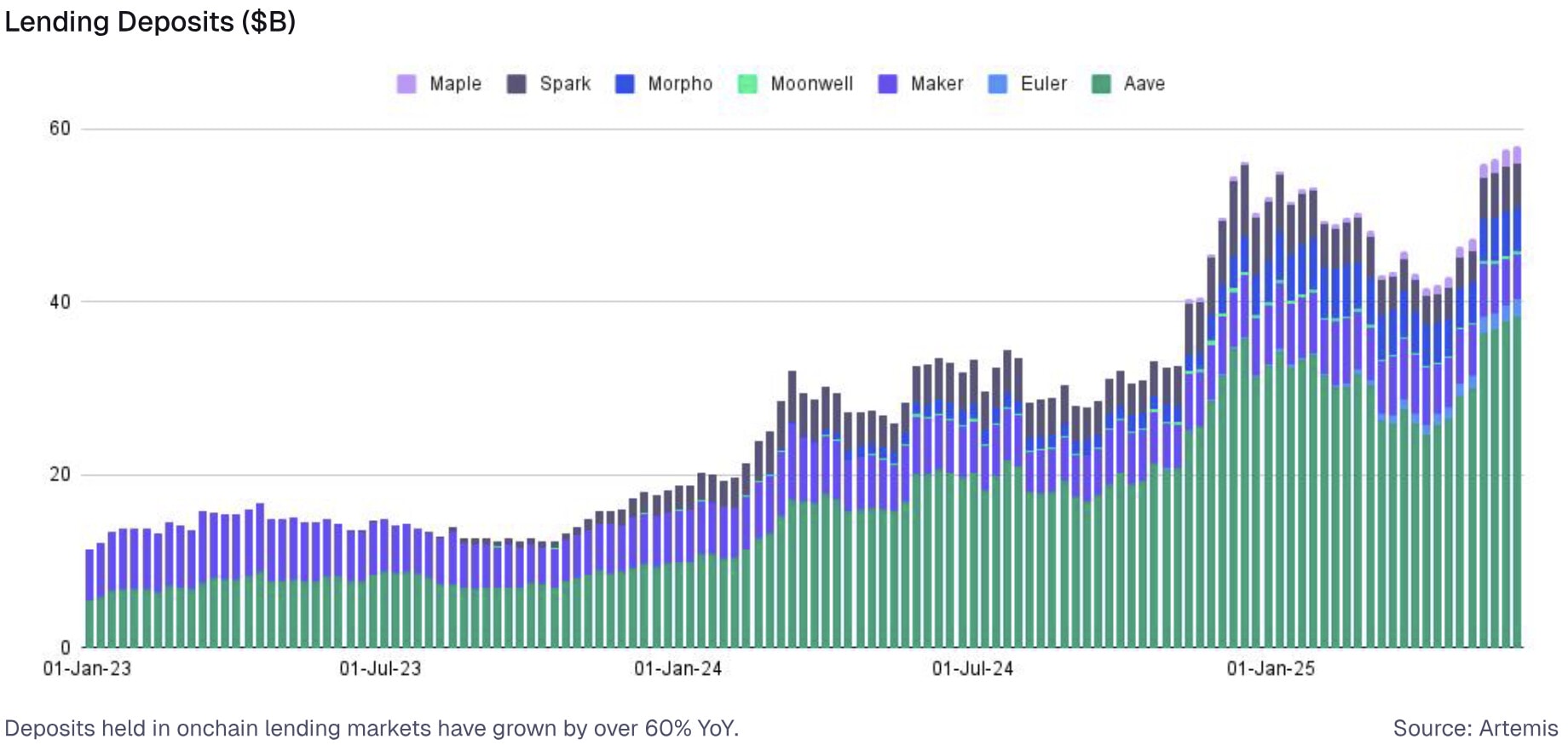

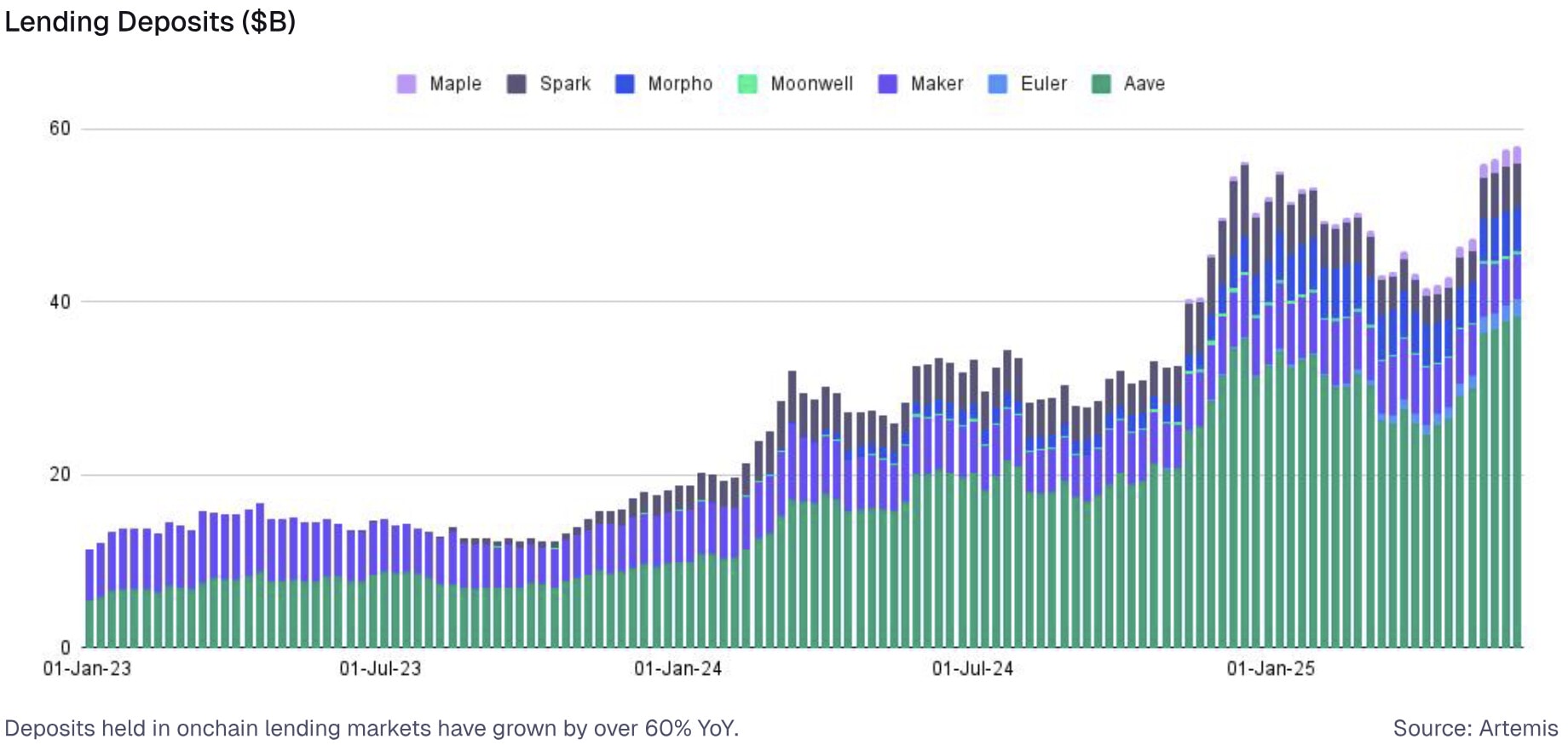

Platforms to obtain a return such as Aave, Morpho and Spark $ 60 billionwith an increase of 60 % compared to June 2024.

This increase was given mainly by the rise of managers of crypto assets. Indeed these “Krypto-Rodák” Managers since January 2025 four times their assets on the chain.

According to the data assembled by Artemis and Vaults, their assets left $ 1 billion for more than 4 billion in just six months.

So we find several well -known actors, for example Glove,, Re7 Or Steakhouse Financial.

On the channel, these managers deploy sophisticated strategies that combine structured products, tokenized assets (RWA) and excessively collateralized loan.

Defu excels as an invisible infrastructure

This boom can lead to a deep paradigm change. Really, Defi no longer perceived as a simple nicheBut as a financial spine for institutions.

And in the kingdom of the defi, stable AND The assets of the real world (RWA) are kings. Most of these fund managers actually turn to these products to generate yield.

This allows them to take advantage of the defi and protect themselves in the face of volatility.

So we have seen multiplication of RWA products associated with, for example, the US cash register or stablecins that have an internal return. For example, we can quote actors such as Corner basethat offers Revenue on USDC deposited via Coinbase wallet. Or BUIDL The Giant Blackrock Project.

This convergence to the Defi is catalyzed by the American regulatory context. Since its broadcast, the Trump administration continues to soften the rules in this industry. As Paul Atkins, the new Sec President who said he wanted to lighten the regulation of cryptocurrencies in the US.

(Tagstranslate) Decentralized Finance